Good Friends versus Best Friends: How Different Types of Political Connection Work in China

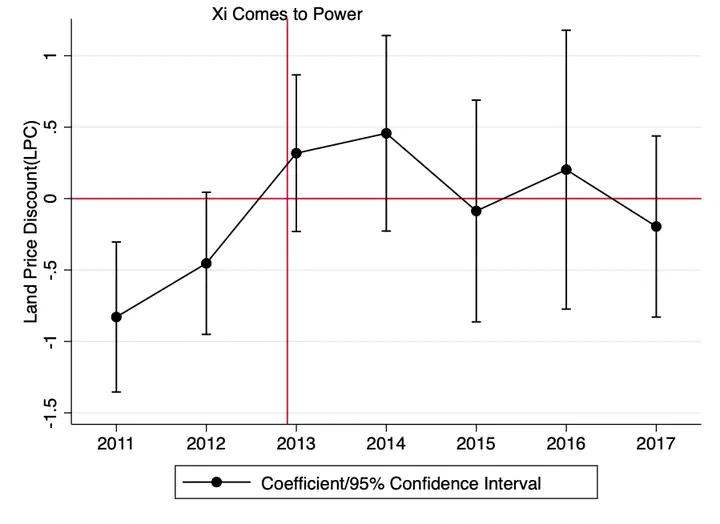

Abstract: This paper differentiates four mechanisms that link firms’ political connections to economic rents and unpack channels through which firms obtain benefits from political ties. Using Chinese public listed firms’ land transaction data as well as a comprehensive dataset of their different types of connections, I differentiate how firms’: (1) reputation, (2) local political influence, (3) access to information, and (4) institutional embeddedness affect land prices and the ways in which firms purchase land. I find that firms with local political influence enjoy a 31% land price discount, the largest compared to other types of connections. More importantly, local connections enable firms to enter into auctions in which they can manipulate land prices before and during the auctions, while firms with good reputations benefit only from restricting potential competitors. My findings demonstrate that different types of political connections differ both in the magnitude of their impacts and the mechanisms by which they work.